Our industry is full of people who have worked hard to build their practices or reach upper management. They’re intelligent, highly skilled, and hardworking. But only a handful have reached the pinnacle in our industry and attained the mantle of ‘the trusted advisor’ in the eyes of their clients.

Why is that? Interestingly, it is only subtle nuances that separate those stand-out performers from the rest.

It has often been said that ‘what got you to here won’t get you to there’, and if you think about it, this premise makes a lot of sense because if the skills that you currently have are capable of establishing you as the trusted advisor, then most of your income will be coming from strategic and advisory services.

Right now, there are a handful of success breakers (workplace habits or skills shortages) that are holding you back from making the next big leap forward. The key is to identify what those are and discover some practical solutions you can use to make the next big leap.

Let’s examine one of the most common success breakers in our industry and the implications it has for you as you move your practice away from compliance and toward strategic and advisory services: withholding information.

This is the refusal to share information in order to maintain an advantage over others.

For a very long time, accountants and bookkeepers have been the gatekeepers of the most vital knowledge in business – financial literacy. Cloaked in jargon, rules that take years to master, and systems that obfuscate financial performance, we have inadvertently created an industry shrouded in fear and mystery.

Most of what accountants do on a daily basis is incomprehensible to a lay person, and for many decades we have gotten paid well because we are in possession of this mysterious yet valuable commodity.

When I speak to accountants and bookkeepers about educating their clients in plain language, one of the most common objections that I hear is, “But if I teach my client how to understand their financial reports, they won’t need me anymore”. Unfortunately, too many have bought into the mindset that keeping clients in the dark is an essential ingredient to maintaining relevance and value.

This argument holds no water when held up to careful scrutiny. It makes no more sense to perpetuate this mindset than it does for a parent not to teach their child how to walk, use utensils, read or graduate from diapers to the toilette. Our job is to support, teach and nurture our clients to become the best and most successful versions of themselves, not to hold them back for fear they won’t need us.

Education enables understanding and growth, and growth is vital to the health of each small business, your practice and the whole economy. As your clients’ understanding and competency grows, so do the complexity of the problems they are confronted with. This growth allows them to turn to you for more challenging, strategic and interesting advice.

Cloud accounting and machine learning are also breaking down those purpose-built walls of specialised accounting knowledge and putting more information, insights and power directly into the hands of our lay person clients. As a result, there is a very real possibility that your job today, as you know, it is going to go away and be replaced by something else.

That is the sole reason why thought leaders, industry bodies and training organisations are urging you to focus on becoming ‘the trusted advisor’. But that mandate is both misleading and elusive.

Our entire industry and the way we educate and train new recruits are focused on technical skills, legislative changes, and GAAP processes. From day one, you are taught to speak to your clients in terms of financial statements, key performance indicators, reconciliations, and forecasts. That is your language and your domain of expertise, not theirs. No matter how colourful or beautiful your reports are, they are still incomprehensible to most of your clients who have never studied accounting and don’t wish to do so.

When you sit down to advise your clients, it’s easy to fall into the trap of ‘explaining accounting’, as opposed to focusing on the specific steps and strategies that your client needs to implement to grow profitably. There is very little training in university, on the job, or in industry bodies to show you HOW to become ‘the trusted advisor’. But unfortunately, there is an overwhelming and distracting emphasis on social media, apps, sales, and marketing.

However, you marketing yourself as ‘the trusted advisor’, no matter how convincingly, doesn’t make it so. It isn’t a designation that we declare ourselves, but rather an honour and a privilege our clients bestow upon us for curing the pain points that keep them up at night.

Becoming ‘the trusted advisor’ is about connecting with your clients and communicating in a way that inspires and empowers them to take action to improve their results. The skills to achieve this are more in line with coaching and training, than sales or marketing.

Where to from here?

If you don’t accept the premise, that your job as you know it is about to change drastically, then you do not need to do anything. You may simply sit back and watch as more and more of what you do is replaced by cloud technology and apps.

However, doing nothing is rarely a viable option in any business or industry. Change is inevitable. It is already upon us.

What got you here – to the success and accomplishments you have already achieved – is not going to get you to where you need to be as our industry continues to evolve rapidly.

Right now you are facing an uncertain future. What that means is that traditional approaches, such as hiding behind the complexity and jargon of our industry, are unlikely to be helpful. In order to evolve and remain relevant despite the changes, you must find a new set of tools, skills, talents and behaviours that complement the ones you already have, not replace them.

Here is a list of strategies that you can use to identify and acquire the new tools, skills, talents and behaviours that will catapult you to the pinnacle of our industry and enable you to become even more successful this year:

1. Specify in writing your targets for growing the advisory services of your practice. These targets must be written down in order to be effective, compelling and measurable.

2. Identify one or two specific niches of clients that you will focus on this year to achieve those targets.

3. Create a list of the two to three most important pain points that these clients have right now (the things that worry them and keep them up at night).

4. Identify and document the key strategies and steps that your clients must take in order to cure the pain points and prevent them from recurring again next month.

5. Critically evaluate the reports, dashboards, metrics and graphs that you present to your clients. Remember, your clients are not accountants and they have no desire to learn accounting. They merely want you to help them fix the problems so they can make more money while doing what they love.

6. Identify and develop the materials that you need to gain leverage on your clients and empower them to take action. When in doubt, ask for advice from trusted colleagues who have proven experience delivering impactful advisory services. It pays dividends to work collaboratively with your colleagues and it also means that you avoid ‘reinventing the wheel’.

7. Be open to trying new things (this includes technology, processes, communication styles, delivery channels, etc). It is only by trial and error that you will uncover what works and what doesn’t.

8. Identify the new skills, talents and behaviours that are needed by every member of your team, and the courses or programs that will help you achieve those results.

9. Create a comprehensive budget for training over the next 12 months and a formal plan for evaluating the progress and competency of each team member. Money spent on your team’s skills to deliver effective solutions is far more impactful than advertising and social media.

10. Start tracking the progress of each client to ensure they are following through on the action plan discussed with them.

11. Open a dialogue with your clients, ask for specific feedback from them about what they have learned, how it has impacted their business, and what you could do better.

This article originally appeared as an interview with Lara Bullock on Accounting Daily website.

It’s impossible to pick up an industry publication without encountering headlines that scream “automation will eliminate most of what you do in your practice in the next decade”.

The concern is a very real and global one – it affects every industry, not just accounting. Proof in point, a 2013 research study estimates that nearly half of employment in America is at high risk of becoming automated in 10 to 20 years, with the accounting profession ranking in the top six of the most automatable occupations.

According to an Australian research paper released by the Centre for Economic Development of Australia (CEDA), “in the next decade there is a high probability that occupations such as accountants, estate agents and even economists will not exist or will be significantly depleted.”

The researchers even go so far as to hypothesise that 94 per cent of what you do right now as an accountant or bookkeeper will be replaced by machine learning and artificial intelligence by 2030.

That is only 13 years from now.

And it’s precisely why thought leaders, industry bodies, and training organisations are urging you to focus on making the shift to advisory.

While some would have you believe that talk of jobs and revenue lost is just simple fear mongering, many firms are right now seeking to move away from backward-looking compliance work (work that describes what has happened in the past and present) which is increasingly being automated by cloud accounting packages and apps. These firms are exploring new value-added advisory services that are not so easily automated and are forward-looking (helping the client to anticipate and deal with change, challenges and opportunities).

These advisory services, can help accounting and bookkeeping firms to future-proof their practices and create faster-growing, recurring, or high-margin revenue streams that make it easier to let go of compliance work.

So, it begs the question, if the future of our industry is cloudy, how many firms are already providing advisory services and what is real the outlook/potential for our industry?

A recent survey by Sageworks found that while many practitioners would like for a large share of their revenue to come from advisory services, the reality is that for many, very little revenue is actually derived from strategic, consultative or advisory work.

Participants of this survey were asked two questions:

- what percentage of firm revenue comes from advisory/consulting work? and

- what percentage would they like to come from advisory work?.

The graph showing the responses to each question are virtual mirror images of each other. While many would like to offer advisory services, most are in fact not doing so today.

Surprisingly, nearly half of respondents said less than 10 per cent of revenue comes from advisory/consulting work, and more than two-thirds put the estimate at less than 20 per cent of revenue. Only 13 per cent said 40 per cent or more of revenue is advisory/consulting.

As for the first question – how much they’d like to come from consulting/advisory work – nearly half of respondents said 40 per cent of revenue. The majority of the respondents said they’d like at least 30 per cent to come from strategic, consulting, and/or advisory.

Unfortunately, our industry and the way we educate and train new recruits is focused on technical skills, legislative changes, and GAAP processes. These establish you as an expert but they are not enough to elevate you into the realm of coaching, consulting or advisory. When you sit down to advise your clients, it’s just too easy to fall into the trap of “explaining accounting” and focusing on ‘what’, as opposed to focusing on the specific steps and strategies your client must implement to grow safely and profitably.

Compounding this, there is very little training in university, on the job, or in our industry bodies to show you how to make the shift into advisory. Contrary to popular belief, advisory is not about selling dashboards, forecasts or apps. It’s about connecting with your clients and communicating in a way that gains leverage and influences them to take action to improve their results.

Right now you are facing a cloudy and uncertain future. Doing nothing is no longer an option.

In order to evolve and remain relevant, you must acquire a new set of tools, talents, and thought processes that complement the financial acumen you already have. The skills, focus, and mindset required to excel in the fields of audit, tax, and compliance are vastly different from those required to excel in the disciplines of strategy, advisory services, and coaching/consulting. The core distinction lies in the difference between whether you are seen to be an expert, or to have expertise and insight.

The client will always pay more money for expertise and insight because their perceived value to the business is much higher.

As an accountant or bookkeeper, you are already a deep subject matter expert in all things financial. However, most of what you do for your clients is focused on the numbers that describe the past and present of the business. These compliance tasks are highly price-sensitive, the scope of work is limited, and it is almost impossible to leverage them to create influence with your client.

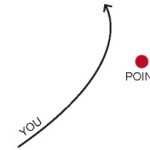

In order to create influence, you must move into the domains of ‘why’ and ‘how’ — these hold the key to helping your clients move forward. Coaching and advisory services are the gateways to ‘why’ and ‘how’, respectively. Figure 1 sets out the three gateways and illustrates the path from accountant/bookkeeper to coach and trusted advisor.

Both ‘why’ and ‘how’ require a future-based, big-picture focus as well as a broad, inter-disciplinary approach. While all three dimensions require deep subject matter expertise, only the trusted advisor possesses the key set of skills, focus, and mindset that leverages their specialized knowledge in a way that is impactful and influential.

*This article originally appeared in the Aug 18, 2017 edition of Public Accountant magazine.

Rhondalynn is also the co-founder of the world’s first advisory mastermind for accountants and bookkeepers Make The SHIFT

04 Jul 2013

Why Do You Need Business Coaching?

As the owner of your business, you are the driver.

As the owner of your business, you are the driver.

Your business is merely a vehicle to help you achieve your goals, provide freedom to do what you want and secure the wealth you need to support your family.

Your financial statements are the key drivers (such as fuel, engine temperature, tire pressure etc.) that tell you exactly where you are at and what it’s going to take to get you to where you want to be.

So Then, Why Do You Need Business Coaching?

Business coaching is your navigation and dashboard – to help you read the key financial drivers and guide your business safely, predictably and profitably to your goals:

Business coaching is vital to help you achieve:

- Clarity on where you are going and the focus to do only the things that will boost your bottom line,

- Guidance and support to choose the most cost-efficient, best and safest route forward, and

- Accountability and measurement to ensure are on the right path and communicating the best targets to your team.

A large percentage of businesses either go under or fail to provide the owner with a fair and consistent income/return for all the hard work and capital invested. Even though you may think that you need business coaching to attract more customers and close more sales, lack of customers is rarely the reason that businesses underperform. In fact, more businesses go under (or get into trouble) due to lack of cash flow, than any other single reason. And cash flow issues can often be fixed cheaply and easily without spending more and more money on sales or marketing. That is why it is so critical to find the right person who can help you identify the problems quickly. Business coaching is not a cost – it is an investment in your future and it can actually help you avoid wasting money on strategies and tactics that will not impact your bottom line positively this month!

Proper planning and financial acumen are the keys to keeping your business on track towards your desired outcomes. Business coaching can provide you with a solid basis to evaluate what your financial statements are trying to tell you about the health of your business, what questions you need to ask, which decisions need to be made right now to guide you in the right direction and what it is going to take for you to step up as a leader and start making better (more profitable) decisions.

Do You Really Need Business Coaching?

If you are just starting out, business coaching can help you avoid costly errors, free up time so that you can focus on tasks that generate the most value for your business and help you get the results that you want quicker. If you’ve been in business for awhile, business coaching can help you achieve profitable growth this year, challenge you to set/achieve loftier targets, expand your leadership and financial acumen, evaluate new business opportunities and plan your exit strategy. Even if you already consider yourself successful, business coaching can help you to step back and look at your business from a new perspective, put solid systems in place so that your venture runs smoothly without you and is more valuable to a prospective purchaser and ensure you have the right strategic plans in place to guard against a downturn.

13 Jun 2013

Why Do You Need a Business Coach?

Do you aspire to be a great leader and grow your business profitably this year? Then it’s time to find the right business coach who can inspire and empower you to step up and reach your goals.

Do you aspire to be a great leader and grow your business profitably this year? Then it’s time to find the right business coach who can inspire and empower you to step up and reach your goals.

Almost every business is under pressure right now to attract more leads and close more sales in this tough economic environment where global competition is increasing every day for your potential audience. It is hard enough to keep up with the changes in your industry and the barrage of ads that target your potential customers – not to mention the innovation in technology, increasing complexity of running your business and complying with the tax legislation, HR issues, operational challenges and business planning. Having a Business Coach isn’t a luxury in this day and age, it is a necessity that you need in order to survive and thrive.

By far, one of the biggest assets that you will gain as a result of working with a business coach is accountability. Remember, it’s difficult to get a truly objective perspective or opinion from yourself, your spouse or your team members, but your business coach is there to be your “unreasonable friend” – to tell you the truth, challenge your assumptions, push your boundaries and motivate you to take action (especially when you are procrastinating).

A Business Coach or mentor will teach you “how to fish” rather than simply putting a fish in your hands when you need it. With years of successful experience (running their own business and helping hundreds of other entrepreneurs just like you), your business coach will help you develop and achieve your goals, put a solid business plan in place, execute effective strategies that will grow your bottom line, track and measure your progress and highlight blind spots or opportunities that you have overlooked.

You may be able to scrape by without the help of a business coach, but it’s almost impossible to consistently grow your business profitably without the training, guidance and focus you will achieve by working with a good business coach.

Find out more today by contacting us to speak to a business coach that can help you breakthrough your perceived limitations, make better decisions, step up as a leader and achieve your goals.

And remember, most importantly a business coach will:

- help you focus and eliminate all tasks that are taking up resources but adding value

- challenge assumptions and perceived limitations about your business and industry

- motivate you to ask better questions and make better decisions

- highlight opportunities or pitfalls that may not be obvious to you

- give you tips and proven strategies based on years of experience across many different industries

- be a valuable sounding board and provide a balanced, objective perspective

- help you develop and execute plans that grow the bottom line and cash flow safely & predictably

- track and measure your financial progress in a way that is meaningful to you

- assist with an exit strategy

- be your unreasonable friend with a wealth of experience across multiple disciplines – marketing, sales, training, systems, leadership, finance, legal issues and technology.

It has often been said that “profit is pointless and cash flow is King”. But do you know why?

It is possible for a business to show a profit for a period of time, yet have negative cash flow. In fact, businesses that have profit (on paper) go under every single day. Negative cash flow, if sustained for an extended period of time, will eventually cause the company to run out of money and cease operations. Therefore, knowing the cash flow position is critical to staying afloat and knowing how to unlock more cash flow is imperative to effectively coach a business owner or senior executive.

Are You Chasing The Wrong Target?

You can have the most brilliant product or service but if the business runs out of cash, it won’t matter. Most businesses make the fatal mistake of thinking that they simply need more customers. If only they had more customers, they would have more sales and more profit…and they would be more successful.

But is this true?

Can businesses simply advertise their way into more sales and better results? No. In fact, advertising and discounting often have a negative impact on the bottom line and cash flow.Simply put – the initial instinct most coaches and business owners have is to focus on increasing sales. Employing this strategy in a business coaching context – chasing customers and sales – is often the worst thing you can do for the business.

The common assumption is that if you are running a business (or involved in business coaching) where the price you charge for your products is greater than what they cost, everything will be okay: you will be profitable and successful. Profit is good – don’t get me wrong – but it is simply not enough on its own. To be sustainable, the business must also have a healthy cash flow.

If you are like most coaches and business owners, you never dreamed that the ability to understand how money flows in and out would be incredibly important. You thought: “That’s for the accountant or finance department to worry about. Sure, they may show me a few reports from time to time, but I don’t see the need to really understand what the numbers mean. If there was a problem, they would tell me, wouldn’t they?”

You probably didn’t realise that all those numbers – the financial DNA of the business – can tell you a lot more than you thought. They can tell you why the business is not growing or is struggling to meet targets. They can reveal why there is less money in the bank account [again] than there was last month.

The financial numbers ARE the story of the business. Numbers don’t lie. They are one of the few objective indicators of how a business is performing and where the problems are. Ironically, financials are the most overlooked area of business coaching with the majority of practitioners choosing to specialize in leadership, sales or marketing disciplines. Unfortunately, without a solid understanding of financials, it is impossible to coach effectively and produce predictable results.

Regardless of any justifications you (or your business coaching clients) use to explain why the business is not performing – the economy, the shortage of ‘good’ staff, competition, supply chain issues etc. – the numbers tell the truth and can lead you to the solution. You just need to learn HOW to use them to your advantage.

You need a bit of Financial Foreplay®.

Are You Avoiding The Numbers?

When is the last time you took two hours out of your week to analyze the financial statements of a client or your own business? Can you honestly say that you know exactly where you (or they) are at and WHY? Do you sometimes wonder what the numbers are trying to tell you? Are you guilty of wasting money chasing new leads and sales instead of fixing the business and making it more profitable?

Most business coaches and business owners make the mistake of assuming they can improve the business by examining the Profit and Loss and Balance Sheet on a monthly basis. Unfortunately, these statements only tell part of the story. In fact, you cannot measure the cash flow position of a business by looking at the bank balance or examining the financial statements at a specific point in time.

This is because most businesses use what’s called ‘accrual’ accounting. Rather than recording ‘money spent’, they record spending as ‘money spent plus money committed to be spent’. So if stock has been purchased on account, accrual accounting includes the value of that purchase from the point it is made – not from the point when the account is paid. Accrual accounting takes into account the amount of money that has been spent plus committed to be spent in the future. The same thing happens in reverse with earnings – it includes money received plus money expected to be received. When a sale is invoiced with 30 days to pay, the value of that invoice is included in accrual earnings even though the money won’t be received for at least another 30 days.

Therefore, when accountants talk of ‘profit’, then, they usually mean ‘accrued profit’ as opposed to what we would call ‘real or cash profit’. Accrued profit is the expected real profit after ‘spending already committed to’, and ‘earnings expected to be received’, are

taken into account along with real (cash) spending and real (cash) earnings. As a result, the profit showing on an Income (or Profit and Loss) statement is a more complicated and less useful representation of the current financial situation of a business. Net profit cannot be relied upon in isolation to gauge the financial health of a company.

Stated another way, cash flow must be tracked over a period of time and can be measured by the following calculation:

Net profit (year to date)

+/- changes in inventory

+/- changes in accounts receivable

+/- changes in accounts payable and GST and

+/- changes in fixed assets

= Cash Flow

Changes in these 4 items on the Balance Sheet have a significant impact on the cash flow and viability of a business. That is why getting inventory levels right, optimizing receivables and payables and investing only in assets that generate a return, is critical when coaching a business of any size. In fact, a coach can often have more tangible impact and influence on a business by focusing on these 4 areas than on directing effort towards gaining new customers and increasing sales. And oftentimes, it costs the business very little to implement highly effective strategies in these 4 areas.

In practice, it is vital to have an eye on both real profit (cash flow position) as well as accrued profit. It is a common error to focus solely on accrued profit – an error which has the potential to send a business to the wall prematurely.

Are You Sure It’s Profitable?

Profitable growth should be the goal of any business. However, you cannot achieve profitable growth without first establishing that the business is in fact profitable. Attracting more leads or closing more sales may not be enough – the costs and efficiencies in a business change every day and this means that we must constantly monitor and measure results and take appropriate action. Focusing solely on customers and sales is a bit like spending 100% of your time practicing your tennis serve while neglecting to watch the scoreboard, analyze the strategy of competitors and practice your returns.

Break-even is one of the most simple and powerful calculations that you can use yourself and with your clients each month to measure and enhance profitability. A company is said to “break-even” for a period (usually a month) when its sales revenue catches up to its costs. Specifically, accountants talk about break-even as the point where ‘fixed costs’ (rent, salaries, etc.) are matched by ‘gross profit margin’ (sales revenue minus COGS).

Therefore, it follows that break-even with profit is the point in the month where the business covers all of the fixed and variable costs and starts making the desired profit target. Remember, if you and your clients are in business and not running a charity, the goal is profitable growth. In order to achieve profit, you MUST in fact plan to achieve it.

Calculating break-even (and break-even with profit) each month and knowing specifically which day of the month the business breaks-even, allows management to make informed, strategic decisions about how to achieve growth that is profitable for the bottom line and enhances the cash flow position.

Are You Ready To Get Results?

Knowing where the financial pain is when you are coaching a business allows you to focus your time and resources where they will make the greatest impact on the bottom line. And if you are truly serious about being a successful business coach, and it is not just a hobby or a way to pass the time, you will find a way to fit a bit of Financial Foreplay® into your day so that you can help others to whip their businesses into shape and start taking home more cash! It’s the quickest and most effective way to get your clients working ON not just IN their businesses.