It has often been said that “profit is pointless and cash flow is King”. But do you know why?

It is possible for a business to show a profit for a period of time, yet have negative cash flow. In fact, businesses that have profit (on paper) go under every single day. Negative cash flow, if sustained for an extended period of time, will eventually cause the company to run out of money and cease operations. Therefore, knowing the cash flow position is critical to staying afloat and knowing how to unlock more cash flow is imperative to effectively coach a business owner or senior executive.

Are You Chasing The Wrong Target?

You can have the most brilliant product or service but if the business runs out of cash, it won’t matter. Most businesses make the fatal mistake of thinking that they simply need more customers. If only they had more customers, they would have more sales and more profit…and they would be more successful.

But is this true?

Can businesses simply advertise their way into more sales and better results? No. In fact, advertising and discounting often have a negative impact on the bottom line and cash flow.Simply put – the initial instinct most coaches and business owners have is to focus on increasing sales. Employing this strategy in a business coaching context – chasing customers and sales – is often the worst thing you can do for the business.

The common assumption is that if you are running a business (or involved in business coaching) where the price you charge for your products is greater than what they cost, everything will be okay: you will be profitable and successful. Profit is good – don’t get me wrong – but it is simply not enough on its own. To be sustainable, the business must also have a healthy cash flow.

If you are like most coaches and business owners, you never dreamed that the ability to understand how money flows in and out would be incredibly important. You thought: “That’s for the accountant or finance department to worry about. Sure, they may show me a few reports from time to time, but I don’t see the need to really understand what the numbers mean. If there was a problem, they would tell me, wouldn’t they?”

You probably didn’t realise that all those numbers – the financial DNA of the business – can tell you a lot more than you thought. They can tell you why the business is not growing or is struggling to meet targets. They can reveal why there is less money in the bank account [again] than there was last month.

The financial numbers ARE the story of the business. Numbers don’t lie. They are one of the few objective indicators of how a business is performing and where the problems are. Ironically, financials are the most overlooked area of business coaching with the majority of practitioners choosing to specialize in leadership, sales or marketing disciplines. Unfortunately, without a solid understanding of financials, it is impossible to coach effectively and produce predictable results.

Regardless of any justifications you (or your business coaching clients) use to explain why the business is not performing – the economy, the shortage of ‘good’ staff, competition, supply chain issues etc. – the numbers tell the truth and can lead you to the solution. You just need to learn HOW to use them to your advantage.

You need a bit of Financial Foreplay®.

Are You Avoiding The Numbers?

When is the last time you took two hours out of your week to analyze the financial statements of a client or your own business? Can you honestly say that you know exactly where you (or they) are at and WHY? Do you sometimes wonder what the numbers are trying to tell you? Are you guilty of wasting money chasing new leads and sales instead of fixing the business and making it more profitable?

Most business coaches and business owners make the mistake of assuming they can improve the business by examining the Profit and Loss and Balance Sheet on a monthly basis. Unfortunately, these statements only tell part of the story. In fact, you cannot measure the cash flow position of a business by looking at the bank balance or examining the financial statements at a specific point in time.

This is because most businesses use what’s called ‘accrual’ accounting. Rather than recording ‘money spent’, they record spending as ‘money spent plus money committed to be spent’. So if stock has been purchased on account, accrual accounting includes the value of that purchase from the point it is made – not from the point when the account is paid. Accrual accounting takes into account the amount of money that has been spent plus committed to be spent in the future. The same thing happens in reverse with earnings – it includes money received plus money expected to be received. When a sale is invoiced with 30 days to pay, the value of that invoice is included in accrual earnings even though the money won’t be received for at least another 30 days.

Therefore, when accountants talk of ‘profit’, then, they usually mean ‘accrued profit’ as opposed to what we would call ‘real or cash profit’. Accrued profit is the expected real profit after ‘spending already committed to’, and ‘earnings expected to be received’, are

taken into account along with real (cash) spending and real (cash) earnings. As a result, the profit showing on an Income (or Profit and Loss) statement is a more complicated and less useful representation of the current financial situation of a business. Net profit cannot be relied upon in isolation to gauge the financial health of a company.

Stated another way, cash flow must be tracked over a period of time and can be measured by the following calculation:

Net profit (year to date)

+/- changes in inventory

+/- changes in accounts receivable

+/- changes in accounts payable and GST and

+/- changes in fixed assets

= Cash Flow

Changes in these 4 items on the Balance Sheet have a significant impact on the cash flow and viability of a business. That is why getting inventory levels right, optimizing receivables and payables and investing only in assets that generate a return, is critical when coaching a business of any size. In fact, a coach can often have more tangible impact and influence on a business by focusing on these 4 areas than on directing effort towards gaining new customers and increasing sales. And oftentimes, it costs the business very little to implement highly effective strategies in these 4 areas.

In practice, it is vital to have an eye on both real profit (cash flow position) as well as accrued profit. It is a common error to focus solely on accrued profit – an error which has the potential to send a business to the wall prematurely.

Are You Sure It’s Profitable?

Profitable growth should be the goal of any business. However, you cannot achieve profitable growth without first establishing that the business is in fact profitable. Attracting more leads or closing more sales may not be enough – the costs and efficiencies in a business change every day and this means that we must constantly monitor and measure results and take appropriate action. Focusing solely on customers and sales is a bit like spending 100% of your time practicing your tennis serve while neglecting to watch the scoreboard, analyze the strategy of competitors and practice your returns.

Break-even is one of the most simple and powerful calculations that you can use yourself and with your clients each month to measure and enhance profitability. A company is said to “break-even” for a period (usually a month) when its sales revenue catches up to its costs. Specifically, accountants talk about break-even as the point where ‘fixed costs’ (rent, salaries, etc.) are matched by ‘gross profit margin’ (sales revenue minus COGS).

Therefore, it follows that break-even with profit is the point in the month where the business covers all of the fixed and variable costs and starts making the desired profit target. Remember, if you and your clients are in business and not running a charity, the goal is profitable growth. In order to achieve profit, you MUST in fact plan to achieve it.

Calculating break-even (and break-even with profit) each month and knowing specifically which day of the month the business breaks-even, allows management to make informed, strategic decisions about how to achieve growth that is profitable for the bottom line and enhances the cash flow position.

Are You Ready To Get Results?

Knowing where the financial pain is when you are coaching a business allows you to focus your time and resources where they will make the greatest impact on the bottom line. And if you are truly serious about being a successful business coach, and it is not just a hobby or a way to pass the time, you will find a way to fit a bit of Financial Foreplay® into your day so that you can help others to whip their businesses into shape and start taking home more cash! It’s the quickest and most effective way to get your clients working ON not just IN their businesses.

12 Sep 2012

What Does Your Executive Summary Say About You?

While only 2 pages in length, the executive summary is by far the most important component of your business plan or proposal. It is designed to summarize the key elements, capture attention and most importantly, showcase the financial highlights.

While only 2 pages in length, the executive summary is by far the most important component of your business plan or proposal. It is designed to summarize the key elements, capture attention and most importantly, showcase the financial highlights.

So, if you only have 2 pages to convey a significant amount of information and summarize the financial upside, how do you decide what to put in and what to leave out? Which financial features are critical to emphasize?

Depending on the purpose of your document and the intended audience (investment, sale, partnership, strategic alliance, joint venture etc.), you will want to tailor your financial disclosure to suit their needs and expectations. What would they want/need to see in order to make an informed decision?

At a minimum, you need to clearly state what financial input is required from them and what they will get in return – i.e. a share, debt instrument, license, exclusive right etc. Next, highlight the expected net profit and cash flow over 2-3 years. Also, give a clear indication of return on investment (ROI) AND a realistic, well defined exit strategy.

In an executive summary, it is important to be succinct and focused. It is not the time to tell your life story, overpromise with unrealistic projections or overwhelm with too much detail. You will only get one chance to make a good first impression and capture the attention of the reader. In fact, many sophisticated investors have told me they rarely read a business plan or proposal in its entirety. They make their decision on the strength of the executive summary and their assessment of the owner/manager (in terms of character, knowledge, skills and tenacity).

Focus on “what’s in it for them”. Show them clearly how they can benefit and when the result will be crystallized. Give them enough detail to understand the industry, opportunity and unique solution you provide. And most importantly, clearly summarize the key financial metrics of profitability, cash flow and ROI.

In short, make it EASY for them to invest in YOU.

Article Source: http://EzineArticles.com/6107414

It’s an unlikely source for great business advice for entrepreneurs. A story about Billy Beane, the general manager of a major league baseball team at the bottom of the ladder – the Oakland A’s. Crushed by the big budgets and big name players of teams like the New York Yankees and the Cleveland Indians, Beane is forced to take a risk and do something no team has done before – abandon traditional recruiting methods and employ computer-generated analysis to acquire and trade players. And in doing so, he changed the face and landscape of the game forever.

The following quotes from the movie were never really meant for you and your business and yet, they reveal some fantastic truths about life and success that will make you a better owner and leader.

1. You’re not solving the problem. You’re not even looking at the problem.

It is very easy for you to be distracted by all the issues and rhetoric swirling around the actual problem. The more you (or others) have personally invested in the status quo, the more you will be prevented from seeing the real problem for what it is. Seek advice and perspective from people outside your industry — those inside will be emotionally attached to the way things have always been done and thus, they have become part of the problem.

Your number one objective is to determine what the actual issue is, and solve it. You don’t have time to get caught up in meetings talking about why it is a problem or re-engineering band-aid fixes that have not cured it in the past.

2. We’ve got to think differently.

Your business really isn’t that different from the Oakland A’s baseball team. If you’re a start up or a small-mid size business, you’re likely working under some tight (and possibly unfair) resource constraints. If you want to grow and to challenge competitors that have much deeper pockets, you need to level the playing field or you need to change it completely. It is impossible to beat anyone if you insist on letting others dictate the terms. You must start by thinking differently. What would need to change in order for you to have the advantage? What can you do differently right now to achieve your objective? How can you adapt or modify your approach to get what you want?

Playing the game on your competitor’s terms is no longer a viable option. It can only lead to frustration and failure.

3. He passes the eye candy test. He’s got the looks – he’s great at playing the part.

Success often depends on good scouting and recruiting. A common mistake that most of you will make is to recruit team members that you like (and have something in common with during the interview) or who look the part. In order to ensure the survival of your business, need team members that can actually do the job that you need them to do. It doesn’t matter whether the candidate has 15 years of experience at a multi-national or comes highly recommended from so-and-so. None of that amounts to a hill of beans if they cannot do the job. If you want to boost your success this year, get the right people on your bus. If you need a good hitter (someone who can close business) don’t hire a semi-retired catcher who is charming in the interview.

4. Your goal shouldn’t be to buy players, your goal should be to buy wins.

It is important to get the right people on your bus. However, in order to do that, you need to figure out exactly what needs to get done and hire people who can do it. Don’t get caught up in fancy titles, big salaries, stock options and what looks good to the outside world. If you want to be successful you must be in the business of plugging gaping holes and buying outcomes.

If you need more customers and sales, hire someone that you know can and is incentivized to close business. It doesn’t matter what you call him, what matters is that he can produce the result that you need to survive and thrive in your business.

5. Why do you like him? Because he gets on base.

Step 1 – figure out what success looks like for the role you need to fill. Step 2 – don’t hire anyone without a proven track record of achieving that outcome. Step 3 – Get rid of (or trade) anyone who can’t fulfil their role or who is polluting the office environment.

6. Where on the field is the dollar I’m paying for soda?

It is good to be frugal and smart with your money but it never pays to be penny wise and a pound foolish. If you want to grow your business profitably, focus on the items that will have the biggest impact on your bottom line and cash flow first. There’s no point focusing on shaving one or two thousand dollars off your fixed expenses if you’ve got $25,000 tied up in dead or slow moving inventory. To make good decisions and take action that boosts your bottom line, you need to measure and track your financial KPIs regularly.

7. I’m not paying you for the player you used to be, I’m paying you for the player you are right now.

While you might get away with recruiting based on potential, in the end, you can only reward based on results. Time and time again I have seen business owners struggle with the decision to let salespeople, who are not meeting their targets, go. The decision is really a very easy one. Someone has to go. It’s either them or you. You can’t win a baseball game without putting runs on the board and you can’t build a successful enterprise without hitting sales targets consistently.

8. It’s day one of the first week. You can’t judge just yet.

Patience is a virtue. Don’t pass judgment judge too soon. If someone’s not performing or the team is not quite gelling, take some time to investigate, ask questions and make adjustments. All changes to the team will have a natural breaking-in period.

Too much tolerance can become a vice. Good performers tend to contribute value very quickly – both in terms of their attitude and work ethic. The typical 3 month probation period is more than enough time to make a fair evaluation. When the writing is on the wall, have the confidence to cut your losses and move on.

Despite the Oakland A’s disadvantaged revenue situation, Billy Beane took his team from bottom of the ladder to World Series contender in just a few months. By re-evaluating the strategies that produced wins on the field, they built a winning team with only one-third of the salary budget of the New York Yankees. To do this, they had to do more than just play better a better game of ball. They had to transform the playing field completely.

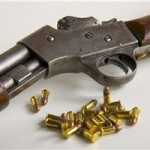

When clients ask how to close more sales and free up cash in their business, I like to tell the story of Byron the guns and collectibles dealer. He lives for his business because it gives him the chance to make a living out of doing what he enjoys most: collecting.

He was struggling 12 months ago because he was out of cash and unable to buy new stock. This was a real problem because the strength of his business lay in constantly having new items to show off. New stock encouraged his customers to come back often; no new stock meant they would tend to check out his competitors first.

When I first walked into Byron’s shop, one of the most obvious items was a beautiful old gun, proudly (and securely) displayed in a glass cabinet. I couldn’t help but ask how much it was worth. He explained that it he had bought it for $5,000 dollars, but was looking to sell it for $7,000. Following a hunch that I had hit on his problem straight away, I asked Byron when he had bought the gun. He didn’t remember exactly, he said, but thought it was about five years ago.

I asked Byron how many other, similarly high value items he had in his store. We went for a walk and in the course of showing me around, he pointed out at least a dozen items which he had bought for over $5,000 over the last few years. In each case, he was quick to tell me how much he was intending to sell the item for, and the margin was always 30 to 40%. But the fact was he hadn’t sold these items so they were costing him money and, most importantly, causing him to miss the opportunity of buying new stock.

Byron had spent nearly $100,000 on expensive items over the years. The items were attractive and valuable, but they weren’t particularly rare, so they weren’t appreciating in value significantly. In effect, Byron had put $100,000 on the shelf of his office and left it there for all that time. In other words, while he wasn’t borrowing money from the bank, in effect he was borrowing it from himself. He had missed the opportunity to invest the money somewhere where it would give him a solid return, such as in a term deposit or in blue-chip shares. And he missed the opportunity of using that money to buy smaller, less expensive items that he knew would sell quickly. He needed to do something (and fast) if he wanted to close more sales.

Compounding all of this was the fact that the global financial crisis had caused demand to drop markedly which meant his customers just weren’t coming in or spending as much as they used to.

By making a few simple adjustments, responding to trends in the industry and addressing a need that his customers, Byron was able to turn his business around, close more sales and double his bottom line.

The first thing he did was to free up some cash by actively selling some of his more expensive and slow moving items. He used online auction sites and his own network to find buyers, while keeping his marketing costs low. In some cases he had to sell the items for a little less than he had intended, but the benefit (when he was able to close more sales) was cash in his pocket.

The next thing he did was set up some systems to keep better track of inventory. He started by recording everything and noting the age of all the items (i.e. the length of time he had held it in stock). We agreed that in future, any item that had not sold after 8 months would be reviewed. Byron would investigate the item’s market value and decide whether or not it was increasing in value sufficiently to be worth keeping. If not, he would act to move the item on.

After a few months, Byron was making much smarter purchasing decisions. He was still enjoying ‘collecting’ for his store, but his focus was different. His focus was less on attractive, expensive but not-so-rare items, and more on smaller items he knew he could sell quite quickly. To his pleasant surprise, he increased cash flow by $100,000 in 3 months and found that by using this strategy, he was able to do more shopping rather than less, because he had more cash available to spend.

Lastly, but perhaps most significantly, Byron introduced 2 new complementary strategies which literally transformed his business. To counteract the soft demand for firearms and the relatively fixed, low margins, Byron convinced his customers to purchase 18 months worth of ammunition upfront and he provided storage (if required) onsite. This allowed him to renegotiate terms and pricing with his suppliers, plus generate more cash flow in the short term. Since the margins on bullets was much higher than on the guns themselves, his overall profitability improved. In addition, Byron incorporated training and certification into his standard offering and opened up his target range to paying customers 3 nights a week. This allowed him to create new, highly lucrative income streams and increase the frequency with which his customers came into his business.

While Byron’s story on how to close more sales might seem unique and industry specific, there are many ways to take the overarching philosophy of what he did and utilize it to improve your operating cash position.

How can you identify and start selling silver bullets in your business? Begin by first examining the big picture…

Identify the items in your inventory that are essentially dead stock – i.e. haven’t sold in over 8 months. Determine what the total value of the stock is and devise a plan to convert it quickly into cash using a minimal amount of advertising.

Focus on the gross profit margin of all of your products and services. Are some of these more profitable than others? To improve your overall performance, concentrate on the former, and improve or eliminate the latter. What items or services could you add which would allow you to service a need, improve your relationship with your customers and grow your bottom line?

Negotiate better terms and/or prices with your supplier in order to increase the amount of gross profit you make on each sale. Consider which items you could sell in bulk upfront to your customers and use this new volume to improve your buying leverage or cut out the middle man.

Marketing should not be treated as a fixed and sacred cow in your business. Do not spend another dime on marketing until you ensure that you are maximizing the amount you retain on each sale to cover fixed costs. Also, only spend money chasing customers and sales if you can measure the financial return that you will get. Unless you are a multinational brand, money spent solely on branding is wasted.

Make it easy for your customers to find you and see what you have to offer on the internet. The database of potential shoppers that you have earned the right to speak to, is in fact your greatest asset. What can you do today to add value, enhance their experience and close more sales?

Finally, examine the fixed expenses in your business. Identify whether or not there is a cheaper, faster or superior alternative that doesn’t compromise quality or customer service. Is there a way to shift how and what you do so that fixed expenses can vary (i.e on a pay per use basis) with the level of production and/or sales? And remember, no one has ever grown their business by [exclusively] focusing on cost cutting – so use this tactic as your final step in a comprehensive plan to get your business firing and hitting targets. Your primary goal is to close more sales and increase the amount of gross profit (or contribution margin) that you make from each sale.

Is your business growth starting to plateau or stagnate?

It’s easy to sit back, take the foot off the accelerator and watch the sales roll in, especially if you’ve been satisfied with your recent performance. But keep in mind that if you slack off too much, your competitors will soon catch up and eventually put you out of business.

Take a look around – businesses (and your competitors) are closing their doors due to the drop in consumer spending – which means MORE potential customers for businesses like YOU, that do survive. Today is the best time to take steps to revamp your marketing efforts and respond to the needs and the pain of your target market.

In these tough times, it’s going to take more than “thinking outside the box” and goodwill with existing customers to secure the survival of your business.

I want you to STOP right now and make a list of everything that you (and your competitors) do NOT do to make it easy for your prospects to buy from you. If you want to succeed over the long term, you will take a good hard look at both of these lists and find a way to do whatever it takes, for as long as it takes, to win your customers and keep them.

Granted, this is not an easy task. Most businesses will continue to do what they have always done – guess or assume what they think their customers need. However, no matter how challenging it is to ask the hard questions and re-engineer your strategy, I guarantee it will be a whole lot less painful and stressful than going under.

I had a married couple come to me once for advice and coaching – both the business they were in and their relationship were at the breaking point. The husband turned and said to me “I don’t understand it. I do everything humanly possible for my wife and she doesn’t appreciate me and I don’t think I can possibly do anything more to satisfy my customers – they are never happy and always want more. What can I possibly do?”

My answer to this age old dilemma applies to him, his marriage, and to you in your business right now. “Sounds like you are doing a lot. Too bad it’s everything BUT the very thing that your partner and customers need most.”

While this may sound harsh, I think you will agree that it is absolutely true. It does you no good to work harder doing everything…instead of focusing on the 1 thing that you customers actually need. Wouldn’t it be easier for you to work smarter, not harder, if you knew with absolute certainty what that 1 thing is?

How can you take the lesson from my client and apply it to your own business right now?

How could you go about figuring out what that 1 thing is?

I want you to do something really radical today and start asking both your prospects and existing customers what they need. You need to find out:

• What is the biggest challenge your prospects are facing in their business?

• When your customer thinks of the product or service you provide, what is THE most painful or difficult issue associated with acquiring it?

• What is the most important criteria to your purchaser when evaluating a company like you?

• What are some things that he/she thinks about or considers from a financial perspective when selecting that product/service or a vendor?

• What is the key strategic driver for you customer’s decision?

It doesn’t really matter what you have done up to this point or how hard you are working. There is no prize for volume or quantity. What counts is quality and relevance.

Are you giving your customers what they want and are you willing to do whatever it takes to help them cure the pain that they are in?

More of the “same old same old” is not going to differentiate you from the pack, build trust, win customers and grow your business. Take some time today to really think about what you offer and how it could be improved to meet the primary need of your customers. If all of your customers were to leave today, what would you need to change in order to win them back and survive?

At the end of the day, price is never the determining factor. Once you uncover the true cost of the problem they are facing, price becomes irrelevant. Your customers will always be willing to pay a fair price for a product/service that cures their pain – not to mention the peace of mind that comes with excellent service. Take stock of what the competition is NOT willing to do and what your customers wnat most from you.

Do something unique – listen and be willing to do whatever it takes to deliver what they want (and need). Anything less, is simply a waste of your time and money on everything that doesn’t really matter.

Article Source: http://EzineArticles.com/6586203