Can Kevin Rudd Buy Your Small Business Vote?

With a hotly contested election just around the corner, The Prime Minister Kevin Rudd has come up with a proposal to allow small businesses to defer lodgement of their Business Activity Statement (BAS) from quarterly to annually. He suggests GST could easily be estimated and paid in instalments throughout the year based on the previous year’s performance.

With a hotly contested election just around the corner, The Prime Minister Kevin Rudd has come up with a proposal to allow small businesses to defer lodgement of their Business Activity Statement (BAS) from quarterly to annually. He suggests GST could easily be estimated and paid in instalments throughout the year based on the previous year’s performance.

At least one journalist for The Age would have you believe this is a “potential recipe for disaster” for small business, but is it really?

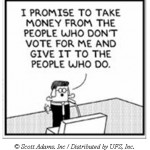

Or is this just another ill-thought-out election promise that makes no sense commercially and achieves nothing of value for the 2million small business owners of Australia?

According to The Prime Minister, small and medium enterprises spend almost 500 hours a year on their tax obligations. What is not clear from this broad statement is what percentage of these hours relate to compliance paperwork and reporting as opposed to the physical recording and tracking of financial information and data.

What is also clearly missing from this research is a calculation of the time and money that is spent by internal and external bookkeepers and accountants in facilitating and managing the entire tax compliance process. These compliance costs are of course borne solely by the small business and add no value to the effective management and profitable operation of the business.

And make no mistake, the external compliance costs are not insignificant. The average small business accounting firm earns less than 20% of its revenue from advisory services. What that means is that the lion’s share of income is derived from compliance work designed solely to calculate, report on and remit tax to the ATO. Ironically, none of the time and money spent internally or externally by businesses on compliance ensures that the small business owner has an understanding of what the numbers mean for the future of the business. This is purely a reporting exercise, not a business improvement one.

In fact, research by leading accounting software firms in Australia revealed that 97% of business owners currently rely on only 2 (out of a possible 300+) financial reports that are available to them, to run their businesses safely and profitably each month. Most had no real understanding of the difference between profit and cash flow and the need to measure and track key performance indicators on a regular business. And the overwhelming majority reported that their accountant spent little or no time with them each year to discuss which specific steps could be taken to improve performance, achieve targets and operate more efficiently.

It is undisputed that cash flow is the #1 killer of small to mid size businesses in this country. Unfortunately, the BAS reporting system (whether administered quarterly or annually) is not the antidote. Having your numbers up-to-date in a software package each month is not enough to ensure the health and survival of your small business. If that were the case, we would have seen a sharp decline in insolvencies when this legislation was first introduced years ago.

The only effective cure to business failure is financial literacy – being able to derive useful insights from your numbers and take purposeful action every day in your small business. To achieve this, more time needs to be dedicated to business improvement. With Kevin Rudd’s proposal, GST would still be paid quarterly (which decreases cash flow) and there is no guarantee that more time would be dedicated by small business owners (or advisors) to gleaning financial insights and developing effective strategies.

While it is not clear who advised Kevin Rudd on this election policy, it is obvious that they have no idea how to run an efficient and profitable small business, let alone manage the budget of an entire country. As a group, the 2 million small business owners of Australia hold an enormous amount of power but they cannot be bought by empty and meaningless promises.

In order to stimulate the economy and create more jobs, policies are needed to completely remove onerous reporting requirements and make it easier for small business owners to focus on tasks that will help them grow profitably. It makes no sense to endorse and put candidates in power (regardless of their political affiliation) who have clearly demonstrated that they lack basic financial acumen.

1 Comment:

By Leanne Steinbeck 01 Sep 2013

So true – our politicians have no clue what they are doing. Half the stuff they suggest is just pain ludicrous. It’s hard to know which idiot to vote for…