Profit (or loss) also known as net income (or net loss) are commonly referred to as the bottom line of a company because this figure sits at the bottom of the Profit and Loss statement. Net profit occurs when there is a surplus (or positive amount leftover) after all the expenses of running the business have been deducted from the revenue billed to customers. A loss (or negative profit) can of course incur if expenses are greater than revenue.

Cash flow is another beast entirely.

Positive cash flow occurs when the net amount of cash that flows in and out of a business during a period of time is greater than zero. In a nutshell, it means that the bank account of the business went up during the period because the company’s liquid assets are increasing. And for those of you following along with the Penny and Ernest metaphor, it means that the amount Ernest collected and put into the bank account, exceeded the amount that Penny spent.

KEY POINTS:

- It is possible for a company to have positive cash flow while reporting a loss on the Profit and Loss

- If a company has positive cash flow it means that it’s liquid assets increased over that period of time

- It is entirely possible for a company to post a loss on its Profit and Loss but still have positive cash flow because it received enough cash from borrowing and investing activities to offset the loss for accounting purposes

ANALYSIS:

Net profit or loss from the Profit and Loss statement is merely the starting point for calculating cash flow. Most businesses use something called “accrual accounting”, which means that profit includes revenue and expenses that may be collected or spent at some future point in time and some non-cash amounts. And if these items haven’t (or won’t) hit the bank account, they aren’t relevant to cash flow.

Since the Profit and Loss contains stuff that hasn’t happened yet (or is not relevant to cash), we cannot rely on it solely to make good decisions for the business. We must remove or adjust everything that hasn’t happened yet or is not relevant to cash, in order to get back to a number that represents pure cash flow. Said another way, we are looking to isolate the amount that Penny and Ernest have each run during the period.

To do this in practice, we need to look at the inter-relationship between the Profit & Loss statement and the Balance Sheet. This holistic perspective will give us a true picture of cash flow.

EXAMPLE:

For example, if we were to start from a position where the expenses of a business exceeded revenue (i.e. a net loss or negative income), the most likely result would also be negative cash flow. It is always more difficult to achieve positive cash flow when the business starts from the position of operating at a loss.

However, it is entirely possible to start with a net loss and simultaneously achieve net positive cash flow, but the following scenarios (which are not an exhaustive list) would have to happen in order for that to be feasible:

- The company could receive an influx of cash from either borrowings (i.e. bank debt) or the injection of further equity via investors.

- If the company has a net loss and also a large amount of depreciation expense recorded, the add-back of the depreciation expense (which is a non-cash item since no money leaves the business when depreciation is deducted for tax purposes) could push the company into positive cash flow territory.

- The sale of an asset, or just the reduction in total fixed assets over the period due to depreciation, could also kick up enough cash to help the company record positive cash flow under certain scenarios.

- The collection of receivables (or other money owed) that were posted in a prior accounting period but were collected and put into the bank in the current period is another simple way to push a company into a cash flow positive zone.

- Expenses are recorded on the Profit and Loss when they are incurred, not when they are paid. If a company posts a net loss due to a large amount of accrued expenses (where they were deducted in computing the loss but are not due to be paid until a subsequent financial period), it is entirely possible that the adjustment for these expenses might enable a company to maintain positive net cash flow, despite recording a net loss for tax purposes.

29 Aug 2013

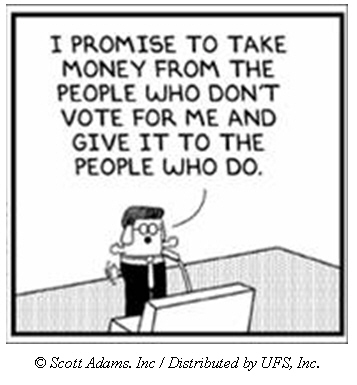

Can Kevin Rudd Buy Your Small Business Vote?

With a hotly contested election just around the corner, The Prime Minister Kevin Rudd has come up with a proposal to allow small businesses to defer lodgement of their Business Activity Statement (BAS) from quarterly to annually. He suggests GST could easily be estimated and paid in instalments throughout the year based on the previous year’s performance.

With a hotly contested election just around the corner, The Prime Minister Kevin Rudd has come up with a proposal to allow small businesses to defer lodgement of their Business Activity Statement (BAS) from quarterly to annually. He suggests GST could easily be estimated and paid in instalments throughout the year based on the previous year’s performance.

Read More

97% of business owners (hard working entrepreneurs just like you) ask themselves 1 question without fail every single day. Do you know what that is?

97% of business owners (hard working entrepreneurs just like you) ask themselves 1 question without fail every single day. Do you know what that is?

Do I (or am I going to) have enough cash to pay x?

Unfortunately, that is without a doubt the worst question you could ask yourself. Knowing exactly where you stand financially (i.e. your cash flow) is critical to your business. Your survival hinges upon your ability to cover all taxes, payments to suppliers and operating costs as they come due.

So if cash flow is so vital – why is this question so very bad for you and your business?

There are 3 common mistakes that I see business owners making every single day – and they relate to that question you’ve been asking yourself. I would like to share them with you right now so you can stop making them and start getting on top of your cash flow position.

- Stop looking for cash flow in all the wrong places – when you ask yourself the question about cash, the most likely thing that you will do next is look at your bank balance. Unfortunately, your bank account merely shows your cash on hand but it will never tell you what your cash flow is or (more importantly) HOW to improve it. Seeing that you do not have any cash is NOT enough. You need to know what your cash flow position is and where specifically cash is trapped in your business. Once you know where the cash is trapped, it will be a lot easier to take action to unlock it and make it available for use in your business.

- Stop relying on a cash position estimate – this second point is related to my first one. I see so many business owners just like you making this mistake every day. And it is not entirely your fault because many of your accounting reports may be incorrectly labelled. Most accounting software packages contain a report that shows your bank balance and lets you project what your cash position might be in the future – for example 30 days from now. They often incorrectly label this a cash flow projection. Actually what you are really doing by looking at this report is very subjective. It takes your bank balance (which we talked about before) and adds all the sales you might have in the future minus the bills you might pay. Unfortunately, this involves a lot of speculation about what might or might not happen in the future and it still doesn’t give you a clear picture of what you need to do to unlock cash in your business. More often than not, this exercise will lead to you focusing more and more of your time and resources on sales – and that activity may actually worsen your cash flow position. Especially if you sell on credit terms or if you sell stock that you need to order in and pay for today.

- Waiting for your bookkeeper or accountant to tell you what your cash flow position is – this is probably the worst mistake of all because it means that you might be waiting for weeks or months with little or no money in your account to pay bills or wages. This is madness. You need to be able to print your profit and loss and balance sheets today and calculate your cash flow right now. It’s not that hard to do and the entire process will take you less than 15 minutes.

The important thing to remember is that cash and cash flow are not the same thing. If your company is profitable on paper yet it maintains a negative cash flow for an extended period of time, eventually it will go under. Being able to calculate and monitor your cash flow position regularly is critical to your company’s health and survival. You can have the most brilliant product or service but if you don’t have positive cash flow, your business will eventually go under.

If you want to learn how to calculate your cash flow quickly and easily, I recommend that you check out Chapter 1 of Financial Foreplay®. It’s been endorsed by the most recognized accounting software brands in the world and it can help you get on top of your numbers and whip your business into shape today.

Knowing exactly where you stand financially – i.e. your cash position – means that you don’t have to wonder “do I have enough money to cover my rent and wages this month?” The health and vitality of your business are dependent upon your ability to cover all tax obligations, payments to suppliers and operational expenses as they come due in your business.

Unfortunately, knowing where you stand is not as simple as looking at your bank balance or your net profit. Your bank account merely shows your cash on hand but it will never tell you what your cash flow is or (more importantly) HOW to improve it.

Cash and cash flow are not the same thing. Cash flow is about the movement of cash in and out of your business as it operates over a period of time.

This distinction is crucial to your success – if your company is profitable on paper yet it maintains a negative cash flow for an extended period of time, eventually it will go under.

But what does this mean for you and your business?

Essentially it means that, “cash flow is King”. You cannot afford to run your business by simply printing and looking at your Income or Profit and Loss statement each month. Being able to calculate and monitor your cash flow position regularly is critical to your company’s health and survival. You can have the most brilliant product or service but if you don’t have positive cash flow, your business will eventually go under.

If you want to learn more about this topic “Finding the Point in business” – improving both your profitability and cash flow, I recommend that you check out Chapter 1 of Financial Foreplay®.

04 Dec 2010

Is Inventory Killing Your Business?

Rhondalynn Korolak

Did you know that inventory is one of the great hidden costs of business?

Business owners should understand its importance of keeping it under control. Visit http://www.financialforeplaybook.com for more on this story…

Is Inventory Killing Your Business?

Did you know that inventory is one of the great hidden costs of business?Very few business owners understand its importance and the significance of keeping it under control. Inventory ties up your cash while providing little benefit to revenue – until the items are sold. Excessive inventory can weigh a business down and ultimately lead to revenue losses.

Excess inventory is so often the primary cause of cash flow problems that it is worth your time and effort to consider how your current stock holdings are affecting the health of your business. And it’s why you should have a clear understanding of how much inventory you have, how much you should realistically have, what it’s worth today, and how old it is.

Every time you buy stock for your business, you should see the purchase as an investment. Like any other investment, you should expect it to provide you with a financial return in a short period of time. If there is a significant gap between when you buy the goods and when you turn them into cash by selling them and collecting the money, you need to re-assess the value of your investment.

When you spend before you earn you are effectively taking out a loan for the intervening period. Very often this will require a ‘real’ loan from some sort of finance company, a delay in paying suppliers or a delay in paying yourself. If you want to improve the cash flow and health of your business quickly and without spending a dime on advertising, take some time out today to review your stock levels and get rid of excess inventory.